It’s been a while since my last update, however since I last wrote, the endowment working group has met together on a further two occasions, to consider how best we invest our £60m endowment from the Cabinet Office.

In my last blog, I talked about aiming for “The Investment Sweet Spot” – this is the asset mix within our portfolio that allows us to achieve both social impact and financial return, all within an acceptable level of risk.

If we want to achieve impact through our investments, it is crucial we understand exactly what impact, with reference to our endowment, means to Access? This is something we have been thinking about, discussing and debating over the past few weeks and it’s been a really useful exercise to focus our minds and even more clearly hone our theory of change.

It is only once we understand what impact we are seeking to achieve with our endowment that we can start to identify specific investment opportunities and make decisions about where and where not to invest. This discussion has been developing and part of the reason for the delay in updating the blog was that I wanted to share with you where we have landed with our thinking.

The overall mission of Access is to improve access to capital for charities and social enterprises to help them become more financially resilient, self-reliant and ultimately have the potential to deliver greater social impact. Given that we believe access to capital is a good thing, we will look to invest in a way which improves access to capital for charities and social enterprises, while achieving our financial goals. At least, this is the hypothesis we hope to test and in so doing share our learning with other foundations. We have defined impact broadly to ensure our approach is one that others will be able to relate to.

Charity bonds are good examples of products that would be an investment spot on mission – by investing a portion of our endowment in charity bonds, we are increasing the flow of capital to charities, who in turn use the funds to achieve their aims and achieve social impact. Another example, might be placing a portion of our endowment in ethical banks, who then lend to charities who use the funds to deliver social impact.

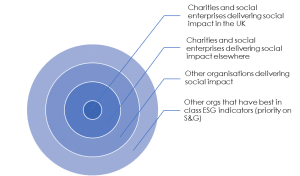

To aid our thinking in terms of product selection and expanding on the investment sweet spot concept, we developed a “bull’s eye” analogy. Given our desired impact, investment products that deliver that impact (together with acceptable level of risks and returns) hit the bull’s eye. In reality, when it comes time to seek these investment opportunities, it may be that we may not be able to fully invest in that space – for example, due to lack of available products. We may therefore need to move further out into a series of concentric circles, representing assets that could deliver impact, but that impact would be further and further away from Access’s core definition of impact. We have developed a graphic that hopefully helps to explain this concept:

Click image to view a larger version

By definition, a bull’s eye is a challenge to hit, but we are determined to do as much as we can to reach this target! We now feel the time is right to start talking with asset managers so we can turn this thinking into reality. By engaging with asset managers rather than investing directly ourselves, our hope is that we will create a model that is easier for others to replicate and encourage asset managers to manage portfolios that achieve social impact.

The endowment working group are meeting again in a month’s time and I look forward to sharing our progress with you!