An independent review of the work of Access – The Foundation for Social Investment (Access) has concluded that the charity has had significant positive impact on the charity and social enterprise (CSE) sector since it was launched six years ago, and that further resources will be required to sustain the blended finance approach.

The review, commissioned by the Oversight Trust, Access’s parent organisation, involved interviews with a wide range of Access’s stakeholders as well as review of materials provided by Access.

The independent panel who undertook the review concluded that Access has had “Significant positive impact on the sector’s infrastructure and investment by providing subsidy into blended capital, via intermediaries, to small CSEs and developing enterprise capacity and resilience among CSEs.”

The report also found that “Access activities have strong sector support and are delivered through an effective agile organisation that demonstrates values and alignment with the sector.”

Interviewees report that Access is “consistent, extremely important, doing something that is very difficult to do and transforming some areas of the market.”

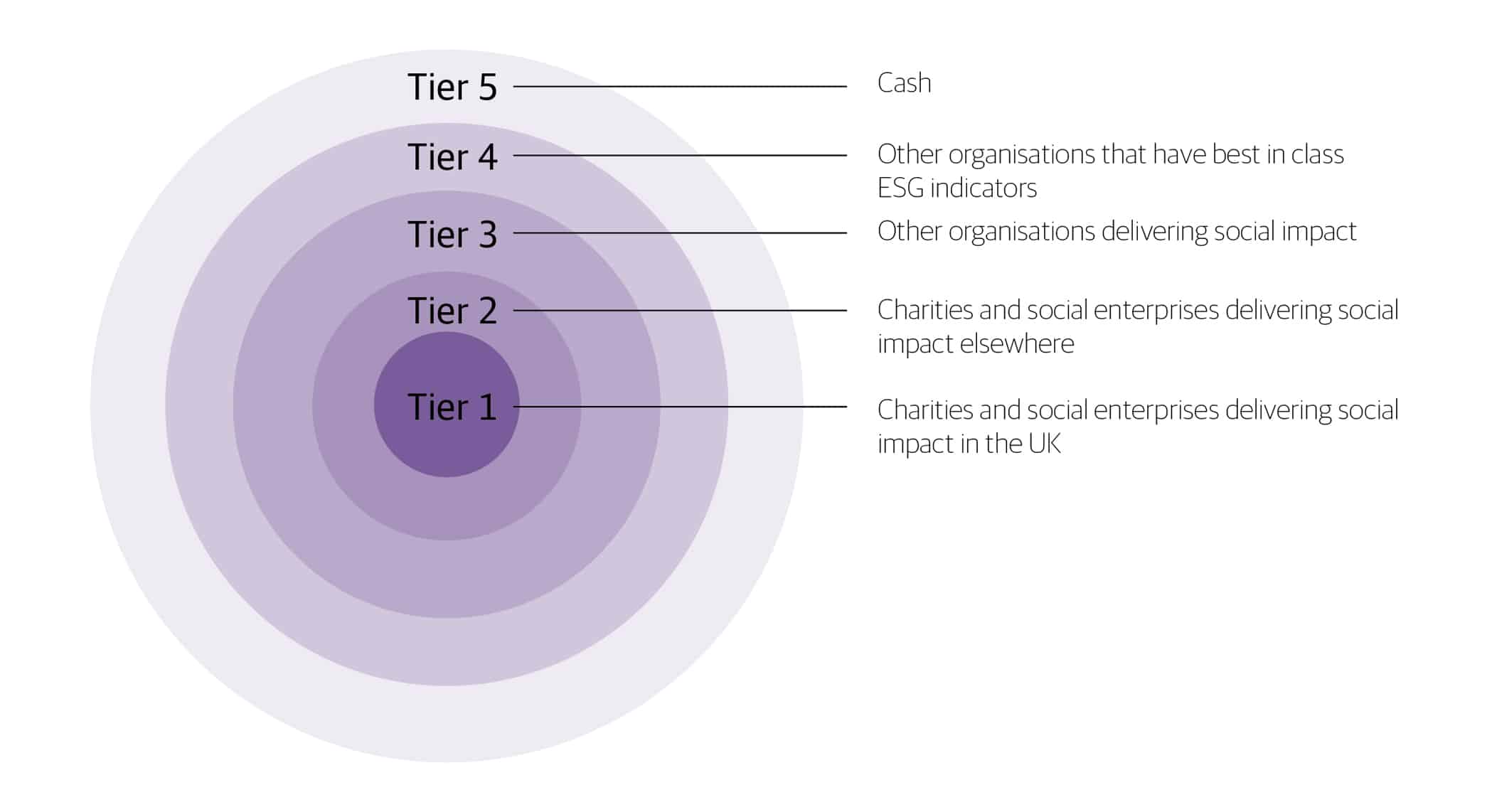

The panel cite Access’s blended finance programmes as examples of this impact: with the Growth Fund having transformed the availability of capital for smaller charities and social enterprises, to a point where it now constitutes c. 20% of the social investment market. The Growth Fund provides social investment intermediaries with £22.5m of grant originally from the National Lottery Community Fund, co-invested alongside a similar amount of debt from Big Society Capital, so they can offer small scale investments to CSEs.

However the Growth Fund will make its final investments in 2022 and the panel highlighted the need for further grant to be made available to support blended finance approaches to continue to serve the sector. Securing the sustainability of blended finance beyond 2022 is one of six strategic issues identified by the panel for Access to consider moving forwards.

Other strategic issues highlighted are for Access to continue to develop its work to reduce complexity across the social investment ecosystem, to continue to develop its role in supporting equality, diversity and inclusion in the sector, develop its broader advocacy role, and further define its longer term legacy. The panel also reflect on the pros and cons of Access’s lean delivery model and highlight some of the issues which flow from it.

Alongside the report from the review panel, Access has published a detailed response outlining how it plans to build on its successes across these six themes.

Seb Elsworth, Chief Executive of Access, responded to the publication of the panel’s report:

“The independent review into Access’s work represents a great vote of confidence in the Access team and our many partner organisations; together with whom we are seeking to change the way the sector is financed and supported over the long term. The impact that our grant programmes have had not just on the 1000+ plus organisations who have directly benefitted but on the social investment ecosystem is increasingly clear”.

“But the report also rightly highlights the ongoing challenge of finding the significant long term flow of grant required to sustain blended finance models. If we aren’t able to resource a successor to the Growth Fund then many organisations will no longer be able to access the finance they need, just as the sector emerges from the pandemic. We agree with the panel’s view that this is the number one priority for Access moving forwards and we are working with a range of stakeholders, including Government, to seek to achieve this”.

“I would like to thank all of our stakeholders who generously gave their time to provide their valuable views through the review process. I would also like to thank the panel for their rigorous and insightful work and to the board members and team at the Oversight Trust for their guidance”.

The following documents are available on the Oversight Trust website: