The second lesson that we have learnt over the last 5 years is that capital without blend will fail to meet the needs of many charities and social enterprises, which is why Access has given blended finance a home.

The demands on charities and social enterprises are as great as ever and so are the resource challenges for the sector. The key area of growth for the sector over the last decade has bene enterprise. This can ben facilitated by greater access to capital to boost trading and generate revenue, but historically access to capital has been a real challenge in the sector.

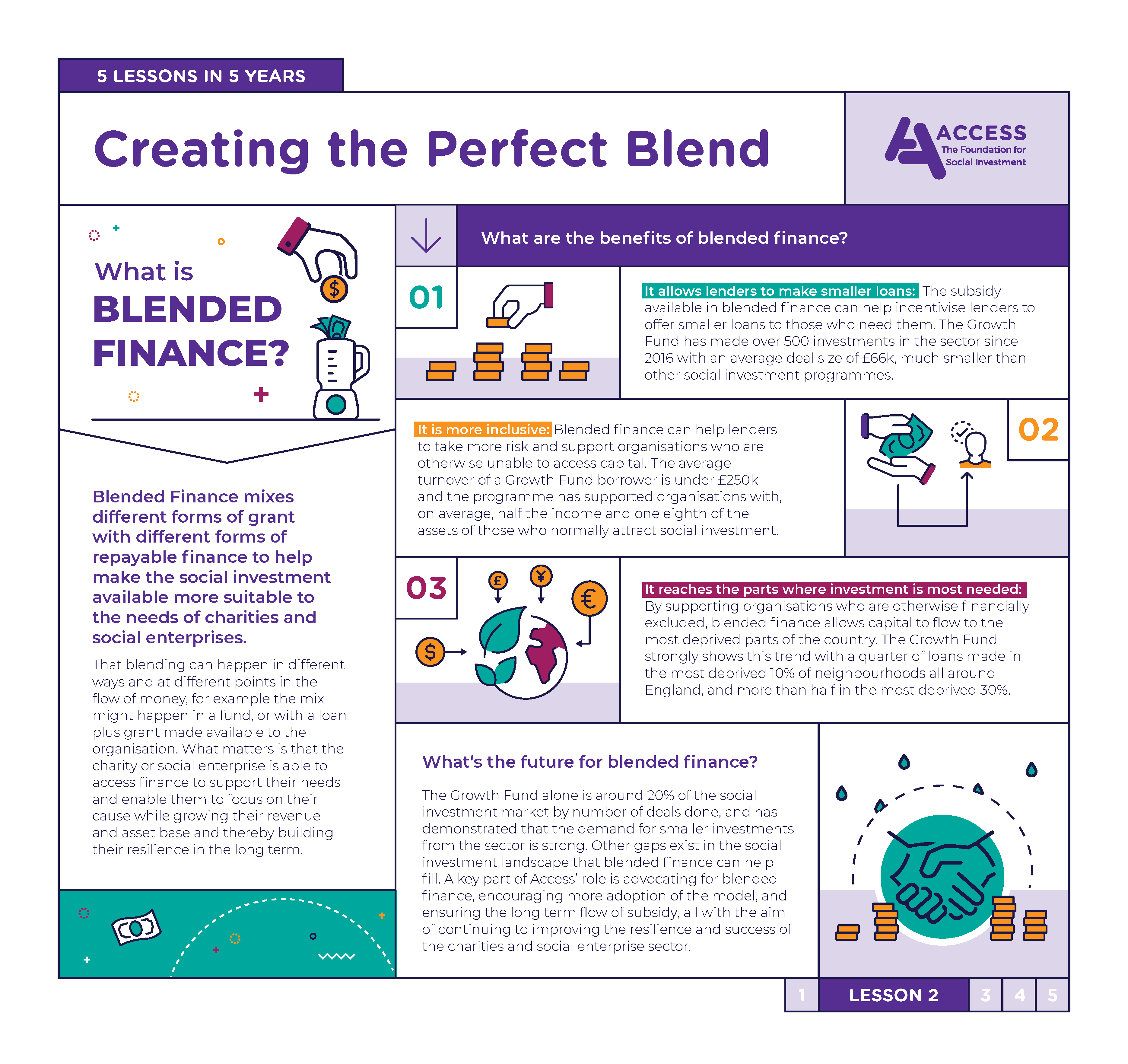

Blended Finance mixes different forms of grant with different forms of repayable finance to help make the finance available more suitable to the needs of charities and social enterprises. That blending can happen in different ways and at different points in the flow of money. In some cases charities are not even aware of the blended aspects of their financial package. Just that they’ve been able to access finance to support their needs and enable them to focus on their cause while growing their revenue and asset base.

Over the last 5 years Access has championed a particular approach through our Growth Fund but although blended finance is the model we advocate, we certainly didn’t invent it, rather built on an already a great track record. Yet for blended finance to really positively impact on the sector much more capital needs to be made accessible; something that historically has been a real challenge. That’s why over the next 5 years we see our role at Access as being not only offering our own blended finance packages but also advocating for others to also support blended approaches, with the aim of continually improving the resilience and success of the charity and social enterprise sector as a whole.

In the second podcast in the 5 lessons series, we hear from Seb Elsworth, Chief Executive of Access who discusses the merits of a blended approach and the impact it is already having across the sector. He is joined by Mathu Jeyaloganathan, Investment Lead at UnLtd who talks about what being able to offer a broader range of products has meant for UnLtd, and we also hear from Andrew Wade, Housing Development and Fundraising Manager for YES Brixham, who explains what access to blended finance has meant for one wellbeing charity in the South West.

If you’d like to hear more and explore this topic further- please have a listen to Access’ second podcast here.

If you have any comments or would like to discuss anything further – please contact sarah.colston@access-si.org.uk