Before Access

Social investment is talked about and touted but the voluntary sector is sceptical about its origins and suitability for their needs.

The voluntary sector is changing. Cuts in public funding are biting hard, particularly at a local level. Government grants have declined significantly. Donations from the public are not increasing. More than four out of five charities are expecting demand for their services to rise, but only 15 per cent of those feel equipped to handle an increase.

It is clear that charities and social enterprises have to change in response. But there isn’t the sufficient infrastructure, support, resources or capacity in the sector to help lead and manage the transition. New ways of financing are needed so the voluntary sector is not left to bear the changes alone.

The coalition government between 2010 and 2015 does a great deal to stimulate the development of a social investment market, this includes launching Big Society Capital in 2012, funding an investment readiness programme, and creating a new tax relief for social investment.

Yet social investment doesn’t appear able to offer the kind of finance that charities and social enterprises need – specifically smaller scale, higher risk, flexible and affordable loans. There is also a lack of support for organisations to build their resilience by developing their enterprise models and accessing the investment that is available.

And too often it’s those organisations that focus on the most underserved places and communities who are missing out on what they need if they’re to sustain and grow the vital work they do.

A National Lottery Community Foundation commissioned report in 2012 highlighted this mismatch:

“Organisations that are looking to raise finance are primarily interested in longer term finance of less than £100,000 to help them scale up their existing activities. This does not match the dominant type of capital on offer to this sector”

Access’s role in the ecosystem

Grants: a lever to stimulate social investment

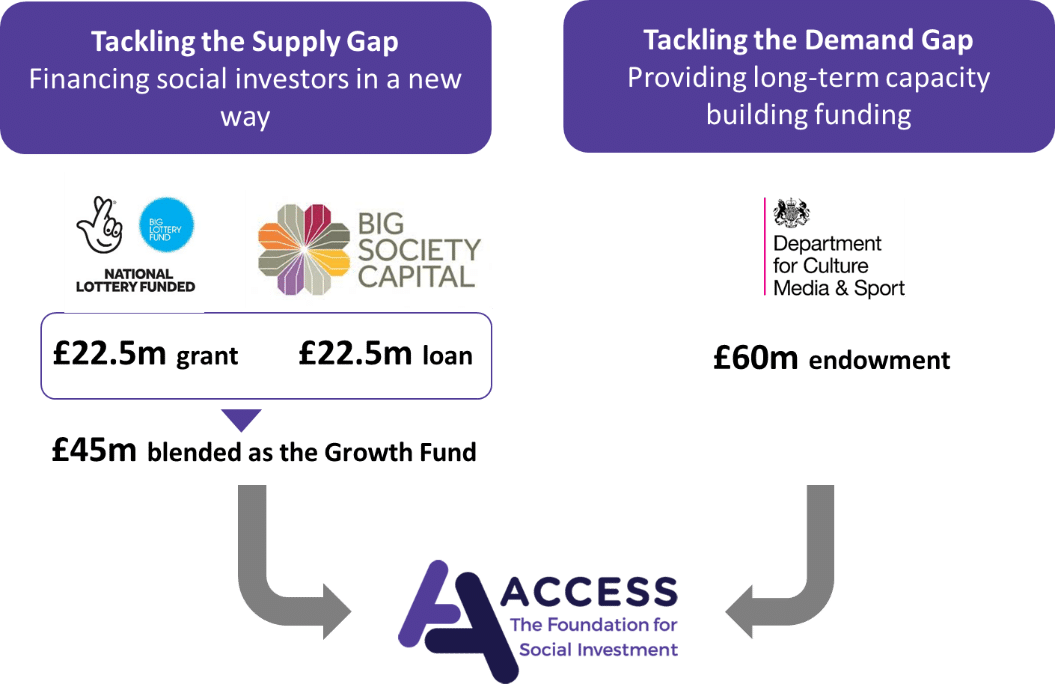

Access is set up by three key partners – the Cabinet Office, the Big Lottery Fund (later called the National Lottery Community Fund), and Big Society Capital.

We set out with a clear remit: to ‘disrupt’ the social investment market by finding a way to, in the words of Heineken’s famous slogan, reach the places that others cannot.

We are tasked with developing programmes to stimulate both the demand for social investment and the supply of the right sort of finance to meet the sector’s needs. Across both strands of work, we use grant subsidy to help build the market.

Access is given a fixed term of ten years to spur experimentation and learning. As a small team, its work has to be delivered with and through partners, in line with a clear set of values. We commit to achieving ‘total impact’ across all of our work, including investing our endowment in line with our mission to get more finance into the sector.

We find allies to experiment with and the narrative of social investment shifts to the resilience of the voluntary sector. Evidence and learning increasingly make this a shift not just of language but practice – charities and social enterprises are increasingly valued and empowered to access a full range of finance that meets their diverse needs.

The Growth Fund

In spring 2015 we hit the ground running, launching the £45m Growth Fund for organisations who want to use a blend of grant and loan to make small-scale unsecured loans to charities and social enterprises.

By the end of 2016 four funds are live and the first loans are being made to charities and social enterprises. We also publish learning from the programme, including initial reflections on the use of subsidy in blended finance.

By 2018 there are 16 funds across 15 social investors totalling £50m. The majority of these are new investors, spread around England, offering a range of approaches to deliver efficiency, innovation and reach into the sector.

By the end of 2018 nearly 250 loans have been made, reaching the right organisations (more than half turn over less than £250k), at the right sizes (average investment is £64k), for the right purposes (to support the development of trading activity), in almost all parts of England.

Jennifer Westwood, Director, Therapist & Trainer from IntraQuest who received an investment from the Northern Impact Fund delivered by Key Fund said:

“We’ve got the business model nailed and the Key Fund has really helped us analyse what’s working and what’s not. It’s been a lifesaver really. As a small business, it’s very easy to go under just because people aren’t paying as quickly as needed. It helped us bridge that gap and stabilise us as a company. And it helped us to analyse our business, particularly the CIC that’s more driven by need. Our vision is big and our heart is big, but we have to do it one step at a time and not be overwhelmed to meet everyone’s needs. Key Fund has been instrumental in bringing about balance to make it a sound business model. It’s given us that breathing space, and helped us focus.”

Building new capacity in the sector

Our initial capacity-building programmes begin in 2016. A three-pronged approach sees the launch of the Reach Fund, the Impact Management Programme, and our support for Good Finance.

The Reach Fund supports charities and social enterprises that are keen to take on investment but need some specific support to overcome barriers. The programme gives charities as much control as possible in shaping their investment readiness plan, with direct input from investors.

By autumn 2018 the programme, run by The Social Investment Business, has made over 220 grants totalling more than £3m. 70 of those grantees have already gone on to raise investment at a total value of over £17m.

Crucially the Reach Fund succeeds in putting charities and social enterprises in control (grantees score their sense of control of the process at 4.3/5).

The Impact Management Programme runs from 2016 to 2019 and offers support for charities and social enterprises seeking to grow their ability to quantify, report on, increase and ‘get paid for’ their impact. Delivered by a partnership led by New Philanthropy Capital, it is co-designed by the sector to ensure it is user-friendly and reflects organisations’ needs.

To address the major challenges charities and social enterprises face in navigating the market, Access supports the development of Good Finance in partnership with Big Society Capital. In the first three years the website and events reach over 74,000 users, and detail nearly 80 investors and advisors.

Overall, Access’s experimental approach to using grants is starting to enable the right kind of finance to reach more charities and social enterprises in more places. The initial suite of programmes has brought learning about where – and how – grants can make a difference to social investment.

Grantees comment:

“This grant was nearly perfect. The grant gave us the freedom to bring in the right people who knew us. We were successful at raising the investment and this grant is the only reason we were able to.”

“We have found it very useful to be allowed the freedom to develop relationships with service providers and manage our own agenda for development.”

In 2017 Access develops a partnership with Barrow Cadbury Trust to support the sector’s infrastructure directly, via the Connect Fund. In its first two years the Connect Fund supports over 50 projects around the country, in both social investment specialist support organisations and the broader voluntary sector infrastructure. These include initiatives around capacity building, data sharing, building diversity and networks, developing standards and templates and promoting market information.

Learning as we go

Our approach to capturing learning from our programmes also begins to evolve. We publish an initial learning report reflecting on the first year of operations, commission a range of research, and select Curiosity Society (formerly known as the TI Group) as our learning partner.

We publish our first quarterly dashboard in January 2017, covering key metrics across all the live programmes.

It’s clear that social investment can be designed for smaller charities and social enterprises. That in turn creates a new willingness to engage and change, which means social investors can feel comfortable working with organisations they previously deemed too risky.

Not talking about social investment

In early 2018, we make a significant pivot – moving away from the language of supply and demand, to focusing on the role enterprising activity plays in increasing the resilience of charities and social enterprises.

We reframe our theory of change accordingly, and in our published strategy identify three broad stages of organisational development where we want to focus our interventions: earlier-stage enterprise development, investment readiness, and the provision of smaller-scale blended finance.

The first of these stages sees us move upstream and launch a new experiment: the Enterprise Development Programme (EDP). This programme works within specific sectors to provide a broad menu of support for charities and social enterprises to test and develop new enterprising activity. Social investment itself is not the goal, the goal is helping organisations to generate more income via enterprising activity which can help build resilience, which may or may not be further enhanced by taking on social investment later on.

A new focus: the social investment ecosystem

We become committed to improving connections between different parts of the ecosystem, supporting enterprising charities and social organisations. This includes adopting the principles of network leadership, recognising only a network of like-minded organisations can effect long-lasting change.

Access’s focus on the needs of charities and social enterprises and experimental approach is much appreciated. It’s felt that we must now do more to influence the development of the social investment ecosystem.

Four years into our 10-year life, we are thinking hard about what we have learned from all our experiments so far, and are building the case for longer term subsidy, in particular for Blended Finance.

The Reach Fund is extended and by end of June 2019 Access’s programmes have funded 829 grants and investments and reached over 716 organisations.

In 2018, £10m of dormant account funds are committed to Access, alongside funds from Big Society Capital, for a new programme called Local Access.

The programme is designed to respond to the specific needs of different places, with more opportunity to develop patient finance models, controlled and managed locally. Following a process of review and selection, six places across England are invited to participate.

In 2020 the economic shock of the pandemic then disrupts many of the business models of the organisations we are trying to support, as well as much of our own work. The importance of organisational resilience is highlighted, and further dormant account releases are made to Access early in the pandemic and then again in 2022 to ensure a continued flow of the right shape of patient and flexible finance to allow organisations to survive and ultimately thrive. We also adapt many of our programmes in the short term to ensure additional grant and support is available to our most vulnerable programme partners and the charities and social enterprises they have supported.

Our fixed-term experiment now needs a long-term future

The work we’ve done alongside our partners proves that an alternative approach – one focused on blended finance and enterprise development – can help finance flow to the places and people that otherwise struggle to access it.

Now we want to make sure all the progress and learning of the past 7 years isn’t lost. What’s needed is a social investment ecosystem that works for all charities and social enterprises, helping to create stronger communities.

Our work so far has shown that this ecosystem must do two things:

Firstly, it has to offer access to the right kind of finance, especially for those who wouldn’t otherwise be able to access it. This means more investors committing their capital into blended finance structures. It means more foundations investing their assets for impact. And it means securing future sources of grant subsidy for blended finance.

The second thing our ecosystem must do is support organisations to build their resilience through enterprise. More charities and social enterprises should have the resilience to withstand the financial challenges we face, and feel confident in explaining their business models, building the resilience of the sector in turn. We also need to see more foundations engaging with, and supporting, enterprise development.

What we’re going to do

Our mission is to make sure charities and social enterprises can access the finance they need to sustain or grow their impact. We aim to achieve this through two broad activities: our programmes and our emerging advocacy work.

1. Our programmes

Through our programmes, we develop the financial resilience of organisations, while making sure more of our money flows to underserved places and communities.

We work to enable the continued growth of blended finance. We will support the capacity and resilience of key partners, while nurturing partnerships that can grow and live independently of us. We will support Local Access places, to champion the role of the social economy, while making the case for more support. And we will promote a better understanding of revenue models in different sectors, highlighting the impact that enterprise grant-making and support can make.

2. Our advocacy

Having seen what our programmes have achieved, we recognise the huge impact blended finance and enterprise development could have if they are adopted more widely. Through advocacy, we now want to mobilise the social investment ecosystem, so it can direct its assets and efforts towards meeting the real needs of the sector – for the long term.

We will make clear the ongoing need for subsidy focused on blended finance. We will support the development of the blended finance ecosystem, and the flow of capital into it. We will work with other asset owners to align their investing with their impact and mission. And with our partners we will help build the movement of enterprise grant-making, while highlighting the vital role enterprise has to play in developing resilience.

Looking ahead

The next three years promise to be hugely important. If, together, we can expand the role of blended finance and enterprise support, it will be a significant step towards making sure charities and social enterprises can navigate an increasingly unpredictable world with confidence.

We’re ready for the challenge – and looking forward to working with all our partners along the way.

You can learn more about our strategy for 2022-25 here.