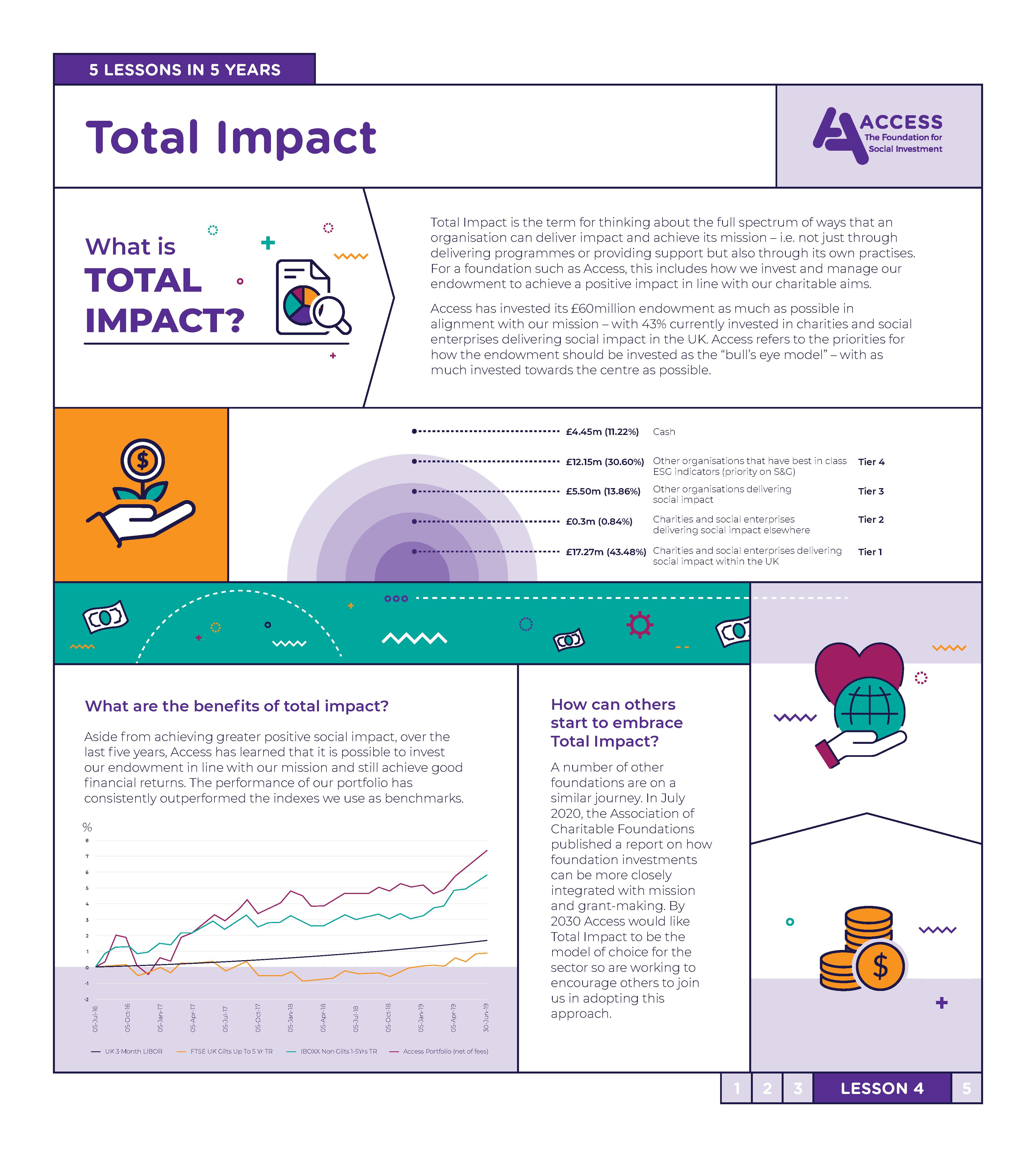

Access was formed in 2015 to improve access to social investment for those charities and social enterprises facing barriers or challenges to acquiring it. Alongside this, Access was given a £60m endowment by the Cabinet Office to be spent on capacity building programmes supporting charities and social enterprises to engage with the social investment market and become investment ready. This endowment was to be invested over Access’ ten year life in order to achieve a financial return and be drawn upon when needed to fund Programme delivery and grants.

However, rather than investing this endowment in the more “traditional” way (i.e. investing it to order to maximise financial returns); Access’s donor wanted the new foundation to adopt a “total impact” approach to its work, and therefore to seek to generate impact from its treasury function as well as grant making.

In 2015 Access developed a set of priorities for how the endowment should be invested in alignment with our mission, and refer to this as the bull’s eye model. The ambition being to invest as much of the capital in the endowment into the centre of the bull’s eye as possible.

Access is not alone in this approach and a number of other foundations are on a similar journey. In July 2020, the Association of Charitable Foundations (ACF) published a report, as part of their stronger foundations project, on how foundation investments can be more closely integrated with mission and grant-making.

Over the last five years, Access has learned that it is possible to invest our endowment in line with our mission and still achieve good financial returns. The 2019 impact report on Access’s endowment illustrates this and is available here. Access would like the total impact investment model to be that of choice for the sector and so we are working with partners to encourage others to join us in adopting this approach.

If you’d like to hear more about the opportunities and challenges around managing a total impact approach in practice – please have a listen to Access’ fourth podcast here. This podcast explores issues from liquidity and risks to the involvement of Trustees to recruiting investment managers.

In this podcast we hear from:

- Martin Rich – Senior Independent Trustee at Access and Chair of the EIC Endowment Investment Committee

- Danielle Walker – Director – Friends Provident Foundation

- Bryn Jones – Head of Fixed Income – Rathbones

For more detailed information on the development and establishment of Access’s approach please refer to our Total Impact blog series on the Access website. The first blog is available here.

For more information about any of our podcasts please contact sarah.colston@access-si.org.uk