Access – The Foundation for Social Investment is set to receive £30m from dormant accounts to create new blended finance solutions for charities and social enterprises in England impacted by the COVID-19 crisis, it was announced this afternoon.

The £30m will be split between enabling existing emergency lending programmes to offer blended loan and grant projects rather than pure loans; and to help create new flexible forms of social investment and expand the range of financing tools available to the sector during the recovery. As it will be blended with other investment capital from a variety of sources, including Big Society Capital, it should significantly increase the availability of finance to the sector to help improve the lives of people and communities.

Seb Elsworth, Chief Executive of Access, said:

“This additional resource for blending is hugely welcome and cements the role of blended finance in the social investment landscape. It will help more organisations to be able to use investment in the short term.

“Crucially looking ahead the sector will need a broader range of investment opportunities to help trade its way into the recovery. This boost of dormant account money will help make that happen and responds to the need which the sector has clearly articulated.”

Minister for Civil Society, Baroness Barran said:

“Since the crisis hit, charities and social enterprises have stepped up their response which has been vital to the national effort.

“Building on our unprecedented package of financial support for the voluntary sector, this additional funding through the dormant assets scheme will ensure organisations receive the right mix of investment assisting the coronavirus response and recovery.”

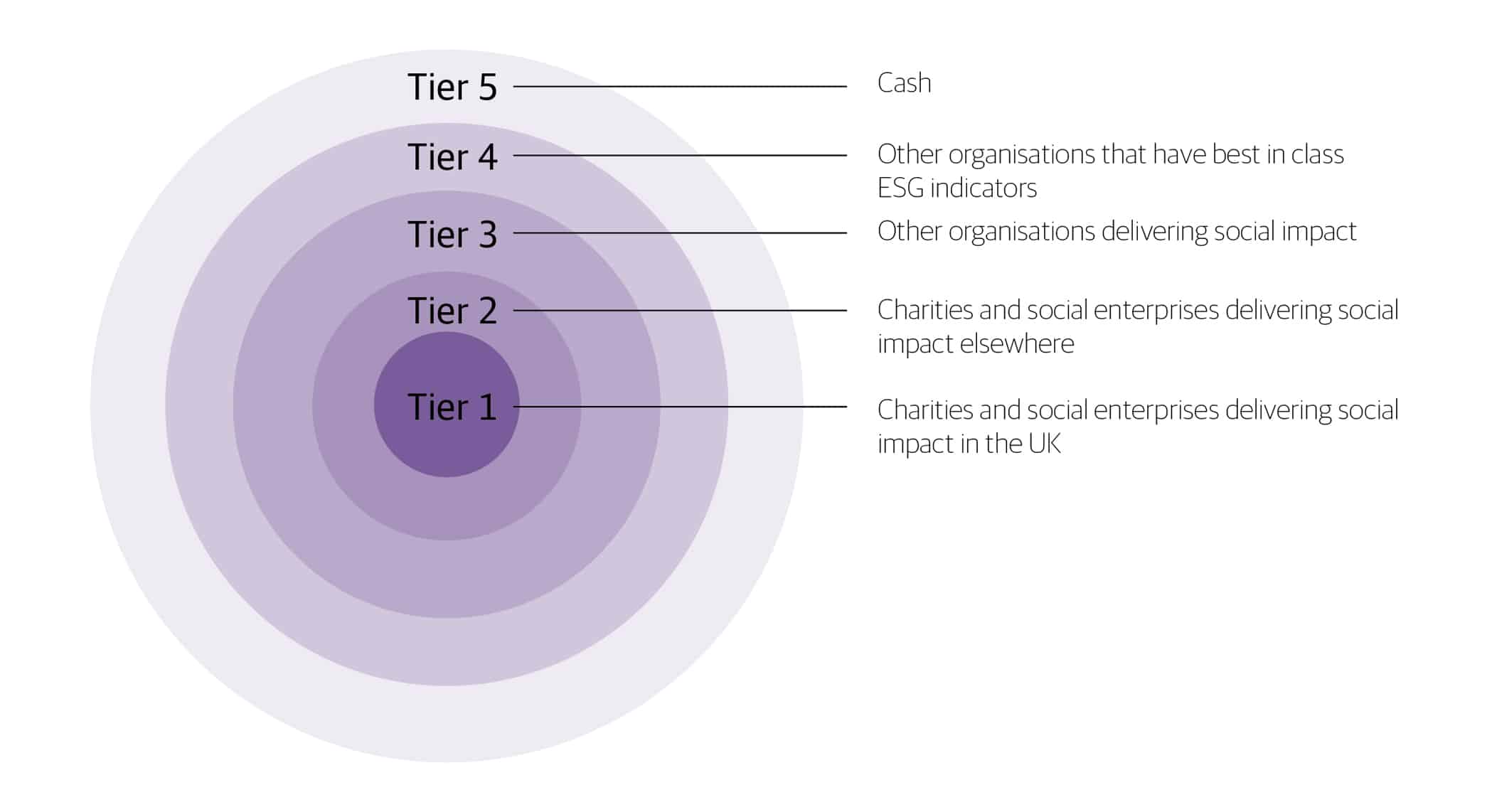

Blended Finance is the use of grant and debt mixed in a variety of ways to make investment more suitable for a broader range of charities and social enterprises. For example the Growth Fund, a £50m blended finance programme and partnership between Access, Big Society Capital and The National Lottery Community Fund, has transformed the social investment market over the last five years. The programme has significantly increased the supply of smaller scale unsecured loans. Over 400 have been made by the 15 organisations who manage the Growth Fund, averaging just over £60k, and the programme contributed around a third of new loans made by social investors over the last few years.

The new funding made available today will complement initiatives such as the Growth Fund and allow for more patient and flexible forms of finance to be provided by social investors for organisations who need support over a longer term.

Access is a wholesaler and so will make the funds available through social investors, not directly to charities and social enterprises. The processes for partnering with social investors to access this funding will be announced by Access in due course.

Elsworth continued:

“We look forward to working closely with our partners across the charity, social enterprise, social investment and foundation sectors over the coming weeks and months to help build more of the investment solutions that charities and social enterprises need.”