This means that we consider the social and environmental impact of all of our work, including the investments we hold in our portfolio.

This Cabinet Office paper details this approach and provides examples from other trusts and foundations. We work with and learn from others who are considering or have adopted this approach and will share findings.

Our Endowment

Our capacity building programme is funded by a £60m endowment we were given by the Cabinet Office in 2015 (this relationship has since moved to the Department for Culture, Media and Sport – DCMS). We fund programmes which help charities and social enterprises to engage with the social investment market and become investment-ready.

Rather than simply holding these funds in the bank before they are given in grants, we use them to make investments which will achieve as much social impact as possible, before being repaid and then used to make grants.

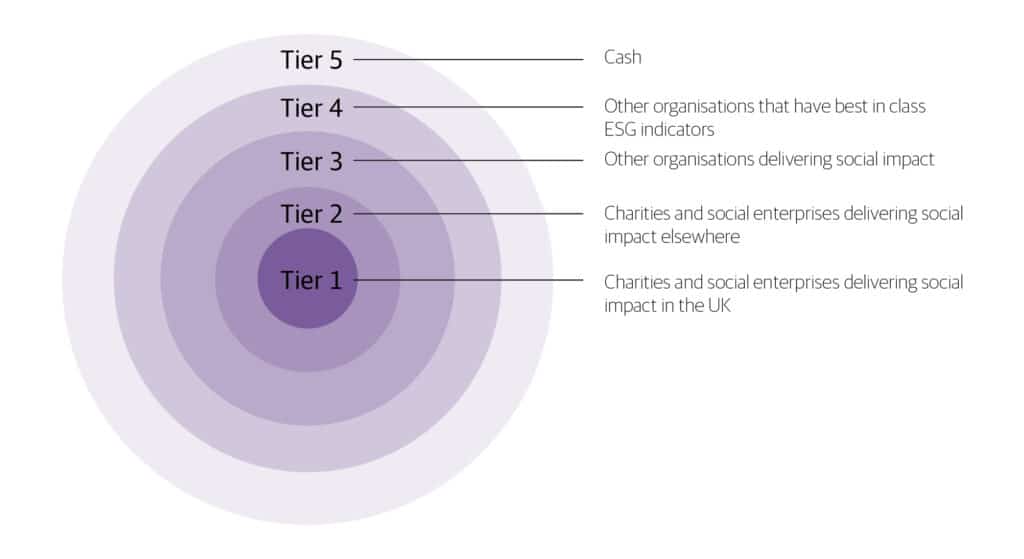

In defining the impact we are seeking to achieve, we developed a set of priorities for how the endowment should be invested which align closely with our mission of increasing the flow of capital to charities and social enterprises. We call this the bull’s eye model.

Access’s Director of Finance and Operations, has blogged on the process which the Endowment Working Group went through to develop this approach, as well as regular updates on the composition of our portfolio.

Rathbones manage the endowment for us and invest principally in social and ethical fixed-income investments such as charity bonds and other ethical bonds. Over time its ambition is to shift as much as possible of the capital in the endowment to being invested at the centre of the bull’s eye.

- 53% of Access’s endowment is invested in organisations delivering social impact, including 35% that is directly invested in UK charities and social enterprises (as at December 2023). The remainder is invested in organisations which have best in class ESG indicators.

- Despite wider economic challenges, the Access portfolio managed by Rathbones has outperformed market benchmarks, achieving a total weighted return (after fees) of 12.73% (as at December 2023).

Our endowment has both a positive impact and good financial performance, outperforming the target benchmarks detailed in our investment policy statement.

You can read our impact report and appendices here:

- Access Impact Report for Access’s Endowment 2023 (including appendices)

- Access Impact Report for Access’s Endowment 2022 (including appendices)

- Annual Impact Report for Access’s Endowment 2021

- Annual Impact Report Appendices for Access’s Endowment 2021

- Annual Impact Report for Access’s Endowment 2020

- Annual Impact Report Appendices for Access’s Endowment 2020

- Annual Impact Report cards for Access’s Endowment 2020

- Annual Impact Report for Access’s Endowment 2019

- Annual Impact Report Appendices for Access’s Endowment 2019

Highlights of our impact in 2023 include our investments supporting:

-

- A more inclusive society and economy: including the provision of support or accommodation to 73 individuals with learning disabilities and management of 50 social housing properties

- Positive climate action and energy security: including renewable energy generation to power 122 average UK homes, avoiding 142 tonnes of GHG emissions

You can read our blog posts about our endowment investment here.

Capital Preservation Fund

In 2018 Access received £10m of funds from dormant accounts to finance our Local Access programme. This money will be blended with around £15m of repayable finance provided by Big Society Capital to provide flexible capital to support the development of enterprise models for charities and social enterprises in six places across England.

Furthermore, in 2020 Access received a commitment of £30m from dormant accounts to provide support to charities and social enterprises impacted by the COVID pandemic.

These funds are managed as capital preservation funds. They will be spent over a shorter period than the endowment and at the time the funds were received the exact timings of spend are relatively uncertain. Therefore in order to meet Access’s total impact objectives the Endowment Investment Committee decided to place these funds with a range of social banks.

This provides Access with comfort that the funds are being used to support lending to social purpose organisations and we can therefore be assured that the capital preservation fund is strongly aligned to our bull’s eye approach.

Investment policy statements

Separate investment policy statements have been created for the Endowment and Capital Preservation Fund to make clear that they are two distinct funds with separate intentions. You can download the statements here:

Investment Policy Statement – Endowment Fund

Investment Policy Statement – Capital Preservation Fund

What we buy

Outside of our programmes, Access doesn’t buy a huge amount. However, we still seek to apply our total impact approach across our procurement, for example:

- We source catering for our Away Days from social enterprises such as Blend Kitchen, Crisis and Unity Kitchen

- Our printing has been done by Jericho Print and Social Enterprise Printing Ltd

- External meetings are held in social enterprise venues such as Black South West Network, CAN Mezzanine, The LIFT and The Foundry

- Our web developers, GreenNet, are a value-driven collective, and our site is hosted by Ecological Hosting, run by renewable energy