Access’s Cost-of-Living programme was launched in September 2023 with the aim of deploying nearly £11 million through 12 social investor partners. The goal was to help the charities and social enterprises supporting communities most affected by the rising cost of living – by quickly scaling up or sustaining their work.

One year later, 10 out of 12 programme partners have concluded their deployment with £7.3 million of Access grant deployed. £12.5 million of total investment has reached charities and social enterprises. Two programme partners are delivering models that significantly differ from others. As agreed at the outset, these partners will deliver £2.7 million of Access grant on different timelines to reflect their distinct delivery approaches.

The fit of social investment and acute need

This programme, backed by funds from the Dormant Assets Scheme, is specifically focussed on supporting charities and social enterprises that are helping communities most impacted by the cost-of-living crisis. The programme targets organisations which have service delivery models based on enterprise activity.

During the pre-programme consultation, many investors understandably shared concerns about their ability to identify a sufficient pipeline of suitable organisations. Charities and social enterprises often face challenges in generating significant revenue or surplus, particularly when their services address the most urgent needs. This is due, in part, to their service users having limited ability to pay, and third-party customers, such as local authorities, facing tightening budgets. As a result, deploying debt, even with substantial grant subsidy alongside, remains a significant challenge for these organisations.

Given these unique challenges, it was crucial for the programme to offer a broader range of products than those available through other Access blended finance programmes. The programme enabled social investors to offer ‘enterprise grants’ to charities and social enterprises needing support to sustain or scale their services, where it wasn’t viable to do so through taking on debt or increasing their level of debt. To date, these have been in the form of Match Trading grants, ‘Crowdmatch’ grants and milestone-based tranched grants (see box).

|

Although seen as a challenge, social investment has still played a significant role in the programme. It has demonstrated that high-impact services, traditionally supported by the state or voluntary income, can be delivered through enterprise and repayable finance models.

To date, 265 charities and social enterprises have been supported, suggesting there is a role for enterprise-based models that can effectively support acute needs. Although repayment performance data is not yet available; it is notable that 40% of grant funds (supporting 75 charities and social enterprises) have been deployed alongside repayable capital. This demonstrates that social investment, with accompanying subsidy, can play an important role in helping to sustain or grow services even when operating in very difficult market conditions.

Leverage

The programme’s £11 million grant allocation is expected to leverage £12 million of repayable capital into partner’s funds, i.e. a ratio of £1:£1.08. While this ratio is lower than other Blended Finance Programmes focussing solely on repayable products, the programme demonstrates that co-investment can be leveraged in different circumstances.

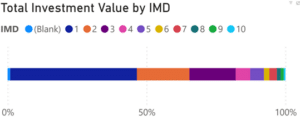

For example, Crowdfunder’s ‘crowdmatch’ grants, enabled charities and social enterprises to generate matched funding for each contribution to their Crowdfunder campaigns. The match ratio varied depending on the Index of Multiple Deprivation (IMD) of the organisation, with those in IMD 1–3 receiving a higher match of £3 for every £1 contributed. As a result, for every £1 of Access grant 58p of additional funds were raised by the Crowd. When also considering funds raised from other funders, the overall leverage increases, with £1 of Access grant achieving 95p in additional investment.

Targeting of communities

Given the nature of this programme, there was an expectation that funds should be heavily targeted to underserved communities. As a proxy for this, we established a target for at least 80% of funding to be deployed to VCSEs based, or delivering their impact, in the 30% most deprived areas according to the Indices of Multiple Deprivation (IMD). Currently, 77% of funds have reached VCSEs in IMD 1–3, falling slightly short of the target but still above the average across Access Programmes (52%).

Interestingly, from partners using enterprise grants where there tends to be more immediate comparable “performance” data, we’re hearing insights to suggest that although this programme has been more heavily targeted in terms of areas of high deprivation, the short-term enterprise outcomes for grantees can be similar to non-targeted cohorts. For example, on SSE’s Match Trading cost-of-living programme they report that grantees, on average, increased trading income by 32% across the course of the programme, only just shy of the 34% average for all previous Match Trading programmes.

Specific cost-of-living needs

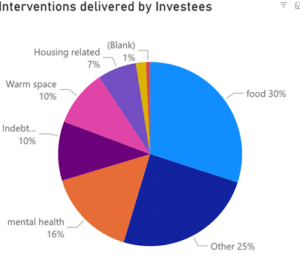

The most common focus has been food-based support (30% of awards), followed by mental health services (16%). Almost 25% of awards were categorised as ‘other’, reflecting that many VCSEs address multiple issues simultaneously, such as food and shelter, or mental health and debt advice. This is particularly common for community-focused organisations who are supporting the person as opposed to the issue. Also within this category are additional needs not captured in the initial categories, including education and training, access to work, family and relationship support, social isolation and loneliness, and physical health provision.

The crisis isn’t over

Although inflation has reduced significantly over the last 12 months, the reality is that many people and communities are still feeling the impact. There remains a pressing need for services addressing the most acute needs. At Access, we are working to better understand how our grant subsidy can support the sustainability and growth of these services and the organisations that provide them.

We anticipate there is a place for investment in different forms, depending on different factors such as the profitability of a service; both where services are already generating significant revenue and some surplus, and perhaps where services generate trading revenue but may never be able to breakeven on their own, given the intensity of the service required.

With the next release of Dormant Assets we hope to be able to support the provision of a wider range of financial products than we have in the past. However, we also seek greater insight into the investment requirements across different trading activities or revenue models which are focused on supporting acute needs. Our routine monitoring hasn’t been designed to shed light on this, but our recently begun independent, programme-wide evaluation aims to contribute knowledge on this, particularly as more programme investees transition through their repayment periods.

See the latest full set of dashboards here.