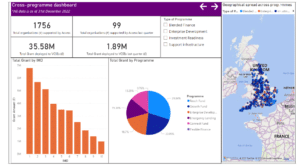

Each quarter we publish an interactive dashboard to share insights from across our programmes. This helps us, our partners and the wider sector to better understand our work.

This blog looks at three highlights from our most recent dashboard (October-December 2022). It also shows some of the ways that the dashboard can be used to dig a bit deeper into our data.

Reaching underserved areas

Across our work we focus on reaching underserved areas, particularly those that have missed out on social investment to date. We measure this using the Index of Multiple Deprivation (IMD) for England, with the aims of making sure more of our money flows to underserved places and communities (so those in the bottom 30% most deprived areas in the country).

Our cross-programme dashboard is a good place to start when looking at this, as it shows a clear relationship between the level of deprivation in an area and how much funding it has received (see the Total Grant by IMD graph above).

The interactive dashboard allows you to click on each IMD decile and see what the data tells you about the grantees in each of them. You can see where in the country our partners are based, how much funding they received, and which specific Access programme they are a part of, all split by level of deprivation (IMD). One important caveat when looking at how funding is distributed by levels of deprivation is that it is based on where the headquarters of our grantees are, rather than where they are delivering their impact (although in many cases this may be the same place).

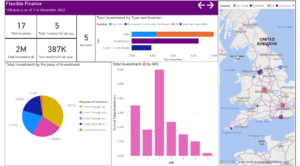

Flexible approaches to Blended Finance

This is the second time that data from one of our newer programmes – Flexible Finance – has been included. This is a £22m programme that aims to offer something that is mostly missing from the social investment market and that many organisations say they need: patient and flexible finance options. It also aims to reach organisations underserved by the social investment market, such as organisations led by people with protected characteristics

Given the flexible nature of the programme, with the mix of grant and investment structured differently depending on the social investor, comparing the data between investors can be quite challenging. However, the dashboard can still give us some useful insights into the programme, such as what organisations are planning on using the investment for. A significant number of the organisations supported by Flexible Finance are using the investment to do something new – either aiming to grow through developing a new product of service (34.4%) or looking to grow through expansion or diversification (21.7%).

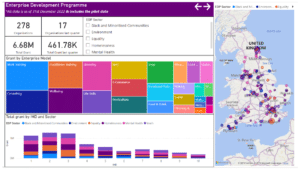

Understanding enterprise models

The final highlight from this quarter’s dashboard is the Enterprise Development Programme (EDP). The EDP aims to help charities and social enterprises in England become more resilient by developing new enterprise models or by growing existing models. It does this through providing a broad range of support. The programme takes a sector-based approach to delivery and is managed by a coalition of partners.

This programme has just entered the last of its five years (including the pilot), and soon will have supported 300 organisations to develop their enterprise activities, increasing their resilience and diversifying their income streams. This final year is an important moment, with the last cohort of organisations recruited (in the Black and Minoritised Communities and Environmental sectors) and a cross-programme evaluation planned to help us better understand the impact it has had.

Now that the programme has been delivering for several years there is plenty of data on the EDP dashboard, specifically around enterprise models (so the kind of enterprise organisations want to pursue) and which is most prevalent in different sectors. For example, in the Equalities sector the most popular enterprise models are Work training, E-Commerce and Consulting, while in the Homelessness sector they are Rent, Events and Food and Drink. This kind of data gives a good steer for charities and voluntary organisations looking to introduce trading or enterprise, as it can help them see some of the enterprise models that others in their sector have pursued. We’ll be digging more into this data in the coming months.

We are just at the beginning of our data sharing and learning journey. We’ll be improving and evolving our approach to data as we engage with our partners and stakeholders to improve our data collection mechanisms and the insights we subsequently share. Do get in touch with us if you are interested in being part of that conversation.