The government has announced today (7 March) that the expanded Dormant Assets Scheme, which will unlock £880 million of forgotten money, will fund much needed investment into organisations tackling social problems in their communities including social enterprises and charities. In addition, the government has announced £31 million of immediate funding from dormant assets to help social enterprises and charities with the rising cost of energy and increased demands as a result of the wider cost of living crisis.

This decision follows an extensive public consultation last summer. A broad coalition from across the social, business and investment sectors came together to feed into the consultation and propose the Community Enterprise Growth Plan – with the goal of supporting social investment to reach places and communities that have not benefited to date. The plan – if fully supported by dormant assets – would create jobs, boost growth and address regional inequalities by unlocking new investment for community enterprises – the community-based businesses, social enterprises and trading charities taking entrepreneurial approaches to tackling social problems.

Today’s announcement creates the opportunity to implement the Community Enterprise Growth Plan by confirming that social investment will continue as a recipient cause of the scheme alongside youth, financial inclusion, and, a new cause, community wealth funds.

Social investment has enabled a vast range of organisations across the country to grow their impact and help more people. Examples range from a social enterprise which intercepts wasted food to provide affordable meals in Sheffield, to a Birmingham enterprise helping ex-prisoners find meaningful employment and a Doncaster based scheme providing affordable furniture to low-income families.

The £31 million funding injection, allocated under the current scheme, will enable community and social enterprises to install energy saving technology in their buildings and help them meet the growing need for their services as a result of cost-of-living pressures.

Marie-Claire O’Brien, Founder and Managing Director, of social enterprise New Leaf Initiative CIC commented:

“Our crucial work supporting nearly 1,300 people with convictions into work has received social investment twice now with the support of Dormant Assets. Most recently social investment has helped us to launch a new ethical recruitment agency which plans to place 100 clients into work in year one, and refurbish our training academy with upgraded equipment, employ an experienced tutor and create a graffiti wall that represents the journey of clients from institutions to employment. Not only that, but the friendly ear of social investors and words of encouragement, signposting, and advice – when times have been tough – have been invaluable, and supported our growth, and that of our clients, as a result.”

Nick Hurd, speaking on behalf of the Community Enterprise Growth Plan coalition, said:

“The Government’s announcement is good news for communities up and down the country. The long-term flow of further dormant assets will provide the finance charities and social enterprises need to help those most in need, including in some of the places most affected by long-term economic decline and most at risk from the cost-of-living crisis.

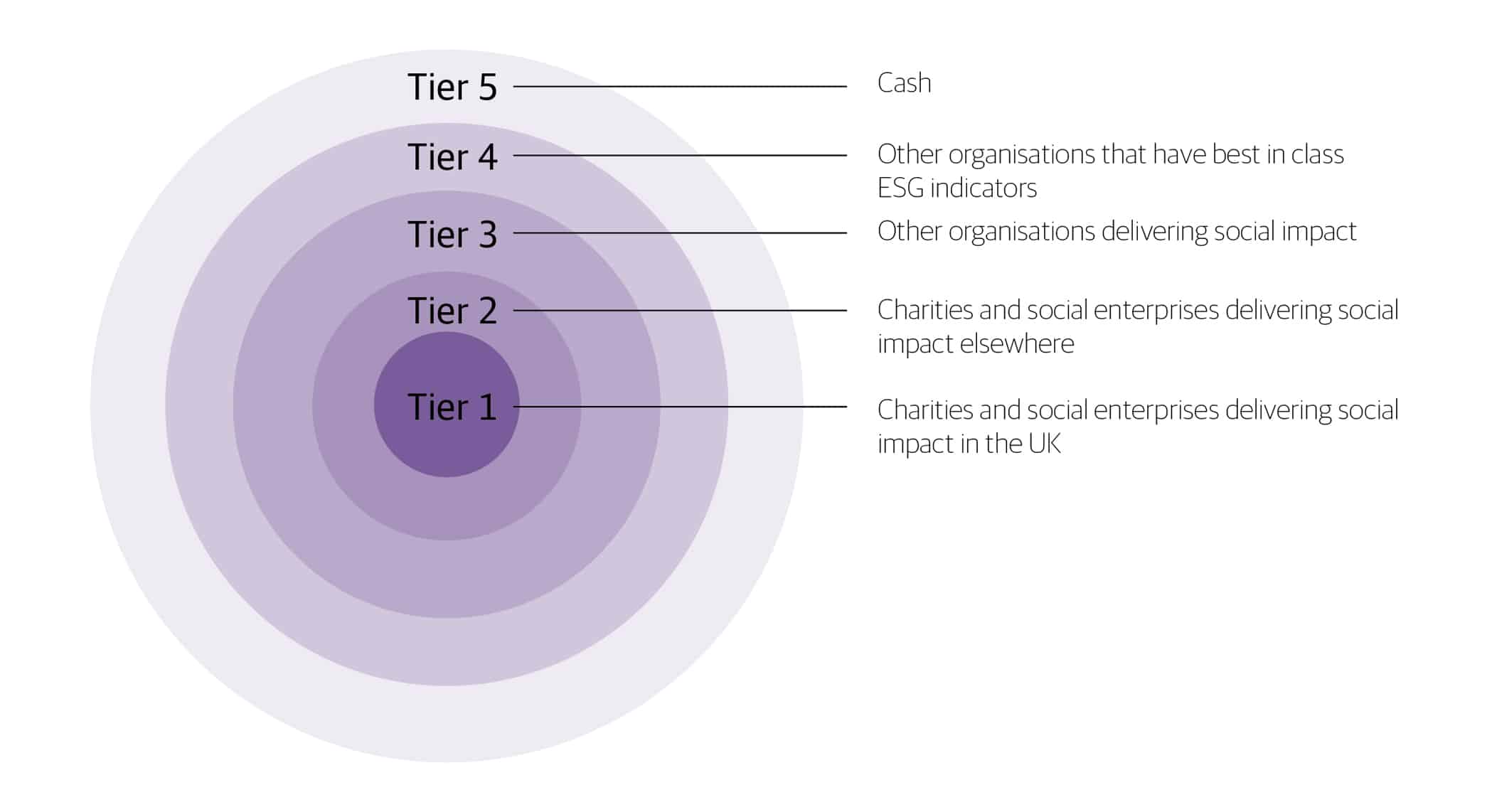

“Over the last decade, in a large part due to the pioneering investment from Dormant Assets, the amount invested in UK charities and social enterprises has grown tenfold with more than £7.9 billion invested in thousands of mission-led organisations working to tackle social and environmental challenges in our communities.

“There is now the opportunity to build on this – through the delivery of the Community Enterprise Growth Plan – expanding the tools and support available to charities and social enterprises and using the social investment infrastructure built over the last 10 years in new ways.”

Seb Elsworth, Chief Executive of Access – the Foundation for Social Investment said:

“There are thousands of projects that have benefited from Dormant Assets to date – many of which are small, community led organisations. Supporting charities and social enterprises through social investment in a myriad of ways – be that helping a community building to make energy saving improvements, launching a new service that will support service users in new ways and generate new income or simply keeping the wolf from the door – providing working capital and helping to maintain vital services in a changing economic environment.

“Further allocations of dormant assets will expand this investment and drive support to communities that have not benefited to date, including places and communities not well served by mainstream finance. This could and should include taking approaches that build on tried and tested mechanisms such as enterprise grants, business support and non-profit community lending.

“But we also know that many charities and social enterprises are being asked to do more with less right now – the £31 million allocation from the Dormant Assets Scheme will help those struggling with rising energy bills by supporting organisations to be more energy efficient and those looking to meet increased demand for their services as a result of the cost-of-living crisis.”

He added “We are pleased to see the addition of Community Wealth Funds to the existing causes – both are needed to support communities in different ways – and we look forward to giving our support to this important idea as it becomes a reality.

Stephen Muers, Chief Executive of Big Society Capital said:

“This is an important step and we welcome the commitment from the government to continue to supporting the enterprises and communities that are helping those most in need at a critical time.

“The social investment infrastructure is already in place, meaning we will be able to deploy funds at pace. And because it catalyses private and philanthropic investment alongside, we can make this money go much further. For example, every £1 from the dormant asset scheme to-date spent on social investment has unlocked another £3 from other investors.”