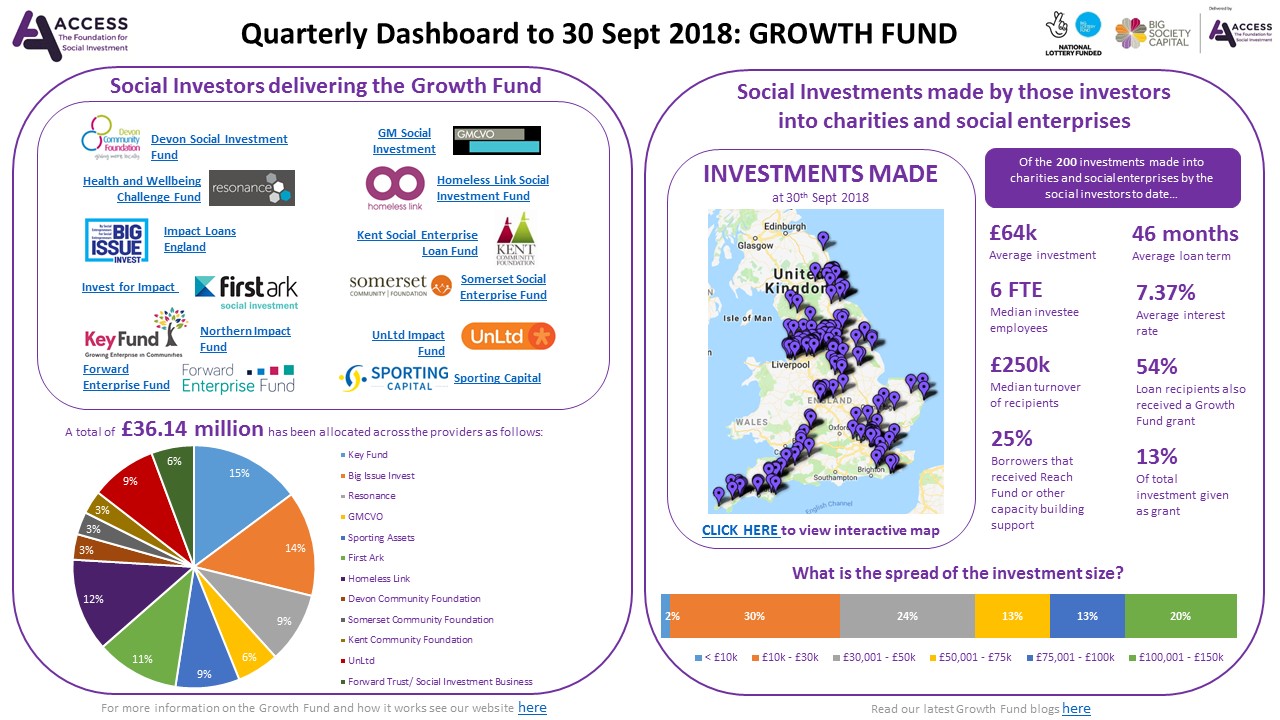

The Growth Fund has been in operation for over two years, with the first fund launching back in the summer of 2016. Since then nearly 200 organisations have received funding utilising the blended finance model, with an average investment size of £64k. Early indications suggest that there is a need for this type of unsecured finance for small organisations, who cannot access capital from other sources – and meeting this need in turn helps those organisations to sustain or even increase their social impact. However the quarterly dashboard data we recently published on our website only tells half the story; to truly understand the challenges facing VCSE investees it’s important to hear their experiences. In some of my recent conversations with these organisations I’ve observed three reoccurring themes:

- Playing the long game

- Failures sit in the quiet corner

- Language can build barriers

As other potential VCSEs begin their investment journey it is worth reflecting on these issues, in order to help future investees & continue to build a better social investment market.

Playing the long game: Receiving investment is only the start of the journey and not the end

For many organisations the process of applying for investment is often long and fraught with multiple obstacles. For some the process can take many months, starting from initial conversations to working through an application paper, undertaking due diligence processes and enduring the scrutiny of investment committee decision panels. Sometimes the VCSE may have obtained a grant from the Reach Fund to conduct some additional preliminary work prior to the investment application process. After going through such a process finally getting to the point of hearing the “yes” and receiving investment might feel like the end of the journey – however it’s only the beginning. The hard work is following through on the proposed business plan, or creating that idea which was previously just a concept. It’s a journey over years not just months ultimately requiring a lot of determination to get to the end. It’s an aspect to be mindful of especially for investors & intermediaries, in being aware of the support needs of the investee over the repayment period.

Failures sit in the quiet corner: It’s important to reflect on successes but also to be honest about failures

Often with time being a scarce and precious resource, an organisation can plough on with delivering its business plan and never take a moment to stop and reassess over the next few years. It’s a useful practice from the outset to set regular intervals to evaluate the success of the project against its initial objectives. Those reflections don’t necessarily have to focus on the financial aspects such as growth & revenue metrics, but could also consider the social impact objectives – e.g. how has the social issue and need been addressed by the project so far? When a project has not had the intended impact either financially or socially, it shouldn’t be a driver for discouragement; rather it should act as a spring-board to ask “why” and be used as an opportunity to revisit some initial assumptions, potentially iterating and trying a different strategy for the future. In those circumstances the evaluation is most valuable when it is an honest assessment of successes and failures. Of equal importance is to take the time to acknowledge and celebrate when those objectives have been met – often something that gets overlooked! Taking the chance to take stock and remind oneself of the original motivations, which can sometimes feel somewhat removed from all the hard work and effort on growing a business, is a worthwhile endeavour. As with any anything it’s healthy to balance both the positive and negative aspects of the social investment journey.

Language can build barriers: Whilst the investment product is meeting the need the language and approach still needs work

The significant take-up of investment within the first two years points towards the blended finance product meeting the needs of VCSEs. Indeed many organisations highlight the inability to find any other financing options for their ideas, or funders willing to back their ambition. However there is still a common wariness towards the social investment market, with many existing misconceptions surrounding it which act as an initial barrier for some organisations. Some of these include: concerns around personal liability, risks of taking on debt, perceiving investment as only for larger organisations or established businesses, not identifying how repayments can be financed through future income streams, lack of understanding as to how investment could help unlock future funding or help transition away from unreliable grant income. On the positive side, these were concerns that were once held by investees – showing that those barriers can be overcome. However, in many instances it was due to the work of the fund managers, building relationships with local organisations and tailoring the language to suit the needs of the individual. If the introductory conversations had been focused on solely on social investment rather than understanding the needs of the VCSE, the journey may not have gone any further. In addition to fund managers some of the best advocates for social investment are those investees, who once held strong reservations about the social investment market. Hearing from a peer-organisation about how social investment helped them achieve their goals, can be one of the strongest influences for an organisation considering taking on investment.

As the Growth Fund continues to mature, with some funds reaching the end of their deployment periods and some VCSEs completing their repayments, more themes will emerge from the stories that VCSEs share. It’s encouraging to see how the investments deployed, have already allowed organisations that want to see real change happen in their communities, to pursue those ambitions and support disadvantaged individuals who need it most. It’s also promising to see how those fund managers / intermediaries, partner alongside those VCSEs who receive investment, supporting them along the journey both pre & post investment. However as the stories of investees highlight, there is still work for both Access and other organisations in the social investment market to do – to ensure the success of the Growth fund and promote the lessons of a blended finance model.