At the start of this year, I shared more on the performance of our endowment as at December 2017. I’m not quite sure how it’s happened, but we already find ourselves in October and after a very busy summer, I have been reflecting on the performance of our portfolio over the last nine months or so.

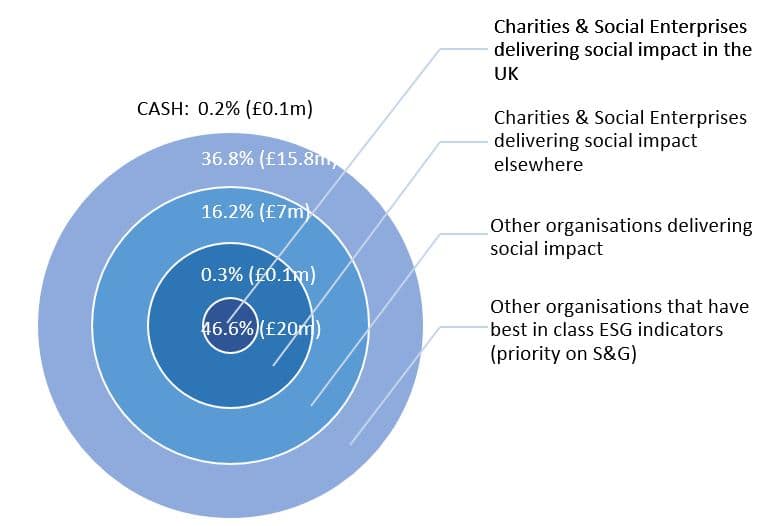

You will be familiar with our bull’s eye approach to investing our endowment and as part of our published quarterly dashboards, we show the percentage invested in each of the bull’s eye rings. But because we are spending down, the percentages show only half the story. From now on, we will be publishing both the percentages and the quantum invested in each ring. Here’s the latest position at the end of September:

As a reminder, the portfolio is invested almost exclusively in fixed income products and as an alternative to cash, our short-term liquidity needs are primarily met by investing in ethical bond funds. As we spend our endowment over the next seven and a half years, we will meet our spending commitments by investing in bonds that mature over the same timeframe. By matching our liabilities (spending commitments) with the assets we hold (the bonds), we negate the need to sell any of the bonds ahead of their maturity.

Of course, Access is fairly unusual in having a spend-down endowment. As we move closer to the end of our life, our investment universe is showing signs of shrinking and many of the more impactful products being introduced to the market seem to have a longer duration than we are able to invest in (the bonds mature after we need the cash.) So, we are starting to think about whether we invest in bonds which may only mature after we cease to exist, but are impactful enough to tempt us to take on some additional risk. In other words, do we risk needing to sell them at a discount when we need the cash, but at least while we hold the bonds, our money has helped to achieve significant impact? Watch this space – we will certainly let you know what we decide!

So how has our portfolio been performing from a financial perspective? We currently have £43m under management, with 47% invested in the bull’s eye. Since July 2016 (our investment start date), the portfolio has achieved a total weighted return (after fees) of 4.7%. So far, this has outperformed our expectations and similar benchmarks, so we are cautiously optimistic.

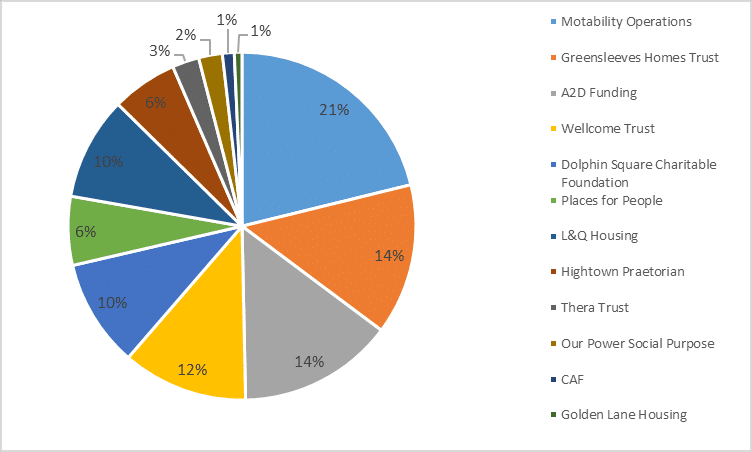

And what about impact? The below chart shows our investment holdings in the bull’s eye – in other words, our investments into charities and social enterprises directly. Access works to make charities and social enterprises more financially resilient and self-reliant and by investing our endowment into these types of organisations, we are hopefully helping these organisations to sustain or increase their impact.

Since I last wrote, we have made two new investments in the Bull’s Eye – Thera Trust and Our Power Social Purpose. Thera Trust seek to demonstrate that people with a learning disability can be leaders in society. Funds raised by their bond issue will help with the purchase of additional properties to provide homes for people with a learning disability, and for their general charitable purposes.

Our Power is a new energy supply company set up in 2016 as a social enterprise by Scottish social housing providers to make energy fairer and reduce levels of fuel poverty. The bond promises 6.5% gross interest per year and they estimate the impact on their customers will be 82.5 days per year of extra heating for a home in fuel poverty if they are on the Our Power standard variable tariff compared to a Big 6 variable tariff.

I am part of a panel later this week discussing sustainable investing as a response to the latest Charity Investment Survey run by Newton Investment Management. Whether you call it ethical/sustainable or impact investing, the debate rages on and it’s great to be able to contribute our experience to help stimulate the conversation.