Our latest dashboard covers the period up to 30th September 2017 and marks one year since we began producing these quarterly summaries. Here we share the headlines.

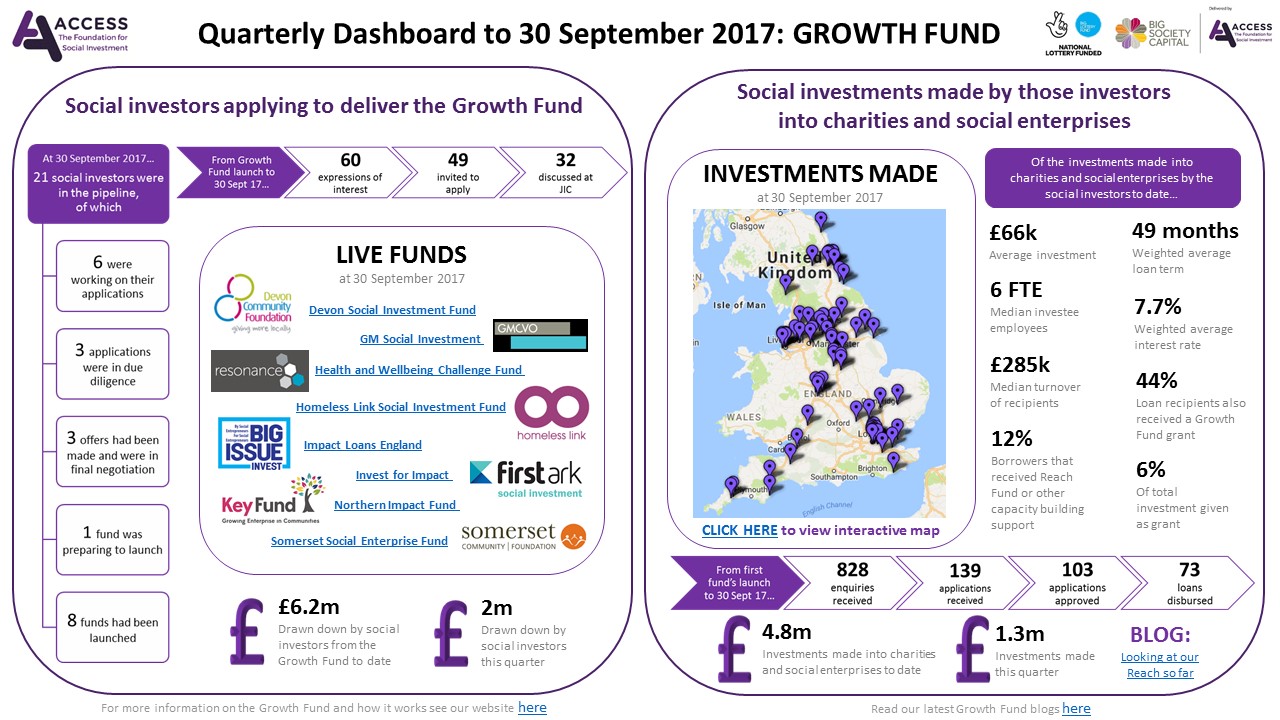

The Growth Fund

The Growth Fund funds organisations to make small (sub £150k) loans to charities and social enterprises in England.

By the end of September a total of eight funds had been launched by a range of social investors, the first four of which had already disbursed funds to charities and social enterprises totalling £4.8m (of which £1.3m was disbursed during the quarter). With the other four funds building their pipelines, receiving applications and getting ready to start making loans, plus several more funds expected to launch over the next year, we expect this figure to continue to increase in future quarters with peak lending activity expected in 2019.

The location of the first 73 loans and details of these investments can be found on this interactive map (and for a more detailed analysis of our early reach see also this October blog post). So far we have seen an average investment size of £66k provided to charities and social enterprises with a median £285k turnover and six (FTE) employees. Although it is still far too early to draw any firm conclusions, it is exciting that the early data indicates that the Growth Fund is starting to fulfil its aims of reaching the smaller end of the market and enabling borrowers to access much smaller amounts than was previously widely available.

The loans so far were made at a (weighted average of) 7.7% interest rate over 49 months. 12% of borrowers received Reach Fund or other capacity building support and 44% received a Growth Fund grant from their social investor alongside their loan.

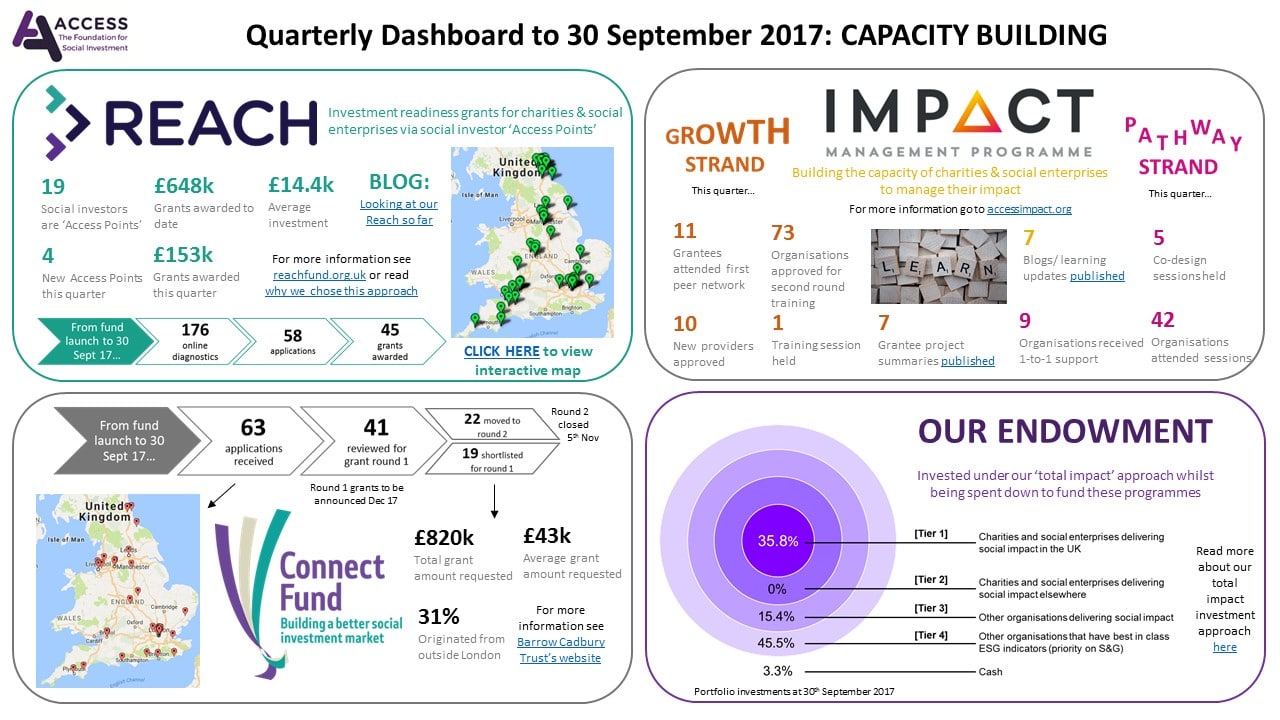

Capacity Building programmes

The second part of the dashboard focuses on our investment readiness programmes.

The Reach Fund provides investment readiness grants to charities and social enterprises via social investor ‘Access Points’. With four more social investors joining the programme during the quarter, the now 19 Access Points had between them awarded 45 grants totalling £648k (av. £14.4k) by the end of September. You can view the recipients and grant details here and some analysis of the fund’s early reach here.

The Impact Management Programme was set up to help build the capacity of charities and social enterprises to manage their impact. In the three month period to September, the Impact for Growth strand approved 73 organisations for their second round of training, ran its first peer network for 11 of the first-round grant recipients and approved 10 new providers to the programme. Under the Pathway Strand, 42 more organisations participated in sessions during the period, including the last five of a series of co-design sessions from which a range of content is now being developed. The programme also published seven more blogs and learning updates during the period.

The Connect Fund provides grants to develop shared infrastructure resources for the social investment market. By the end of the quarter the fund had received 63 applications, 19 of which had been shortlisted for round one. Shortlisted proposals requested an average of £43k and a total of £820k and went to panel in November – the first grants will be announced soon.

These (and future) capacity building programmes and research are funded by our £60m endowment, which we are spending down over our ten year life. However we are seeking to achieve social impact even before the funds are utilised in this way by investing under our total impact approach. At the end of September the proportion of our portfolio invested in the ‘bull’s eye’ of our model (charities and social enterprises delivering social impact in the UK) remained steady at just over 35%.

Updates since September

Whilst the dashboard covers the period up to the 30th September, as always, lots more has happened since!

The Connect Fund has recently approved its first round of grants, details of which will be announced soon. The Impact Management Programme approved its second grants round last month, and both this and the Reach Fund remain open to applications.

We announced in November that the Growth Fund is almost fully committed and issued a final call for those interested in potentially running a fund, asking potential social investors to get in contact before the end of this year.

A note on process

We are publishing these dashboards every three months, approximately six to eight weeks following each calendar quarter’s end. This is for two reasons. Firstly, we want to give our partners, fund managers and programme administrators adequate time to provide us with data on their activity. Absorbing complexity as far as possible and trying not to over-burden social investors and others with excessive reporting requirements and short deadlines is integral to the design of all of our programmes. Secondly, we want to ensure that we take the time to fully understand and analyse all of the data that we have so that we can hopefully provide the most useful summary figures and snapshots of our programmes and funds. We hope that by taking this approach we will be able to maximise both our own learning and that of any interested parties.

At Access, learning and openness are at the heart of everything that we do. We are committed both to learning from all of our activity and to sharing this as much as possible. Our hope is that this will be of benefit to social investors, other providers of loans and grants and others in the social investment market and therefore, ultimately, to the charities and social enterprises which we exist to support.

Our next quarterly dashboard, for the period up to and including October to December 2017, will be published during February. If you would like to keep up to date with our programmes and funds in the meantime you can view our other blogs, subscribe to our monthly e-newsletter and follow us on Twitter. You can also read more of our learning and analysis on our Learning and Research page.