Between now and June, we’re opening up a conversation about our capacity building strategy for the next phase of our life, 2018-21. It’s exciting, this time round, to be able to build on what we ourselves are doing as well as drawing lessons from others.

Looking back to when we launched our initial consultation in 2015, we’ve come a long way. Our three core strands – the Reach Fund, Impact Management Programme and Social Investment Infrastructure Fund – are now in place, and beginning to have an impact on the organisations we exist to support. We have also clearly expressed what success looks like for Access overall, in our recently published learning strategy. Centrally, we wish to see that:

“charities and social enterprises are managing to sustain their impact or achieve greater impact because they are more financially resilient and self-reliant”

While our Growth Fund addresses the supply side – making social investment more readily available to a broader range of organisations – our capacity building work is focussed on stimulating demand. Our key question is:

How can we use our resources to most effectively support organisations to consider social investment, and, where they judge it would support the resilience mentioned above, prepare them to take on some form of repayable finance?

The focus for this conversation, then, is investment readiness. Clearly, we need to learn from others: the Big Potential programme, coming to an end this year, is a significant source of insight, as it has provided support across this spectrum. There is also the City Bridge Trust’s Stepping Stones Fund, and investments made by the likes of Esmee Fairbairn and Barrow Cadbury Trust, and evidence from past programmes such as the ICRF. The role of grant-funders in supporting grantee organisations to consider social investment is another theme we’re keen to explore.

A ‘spectrum of readiness’

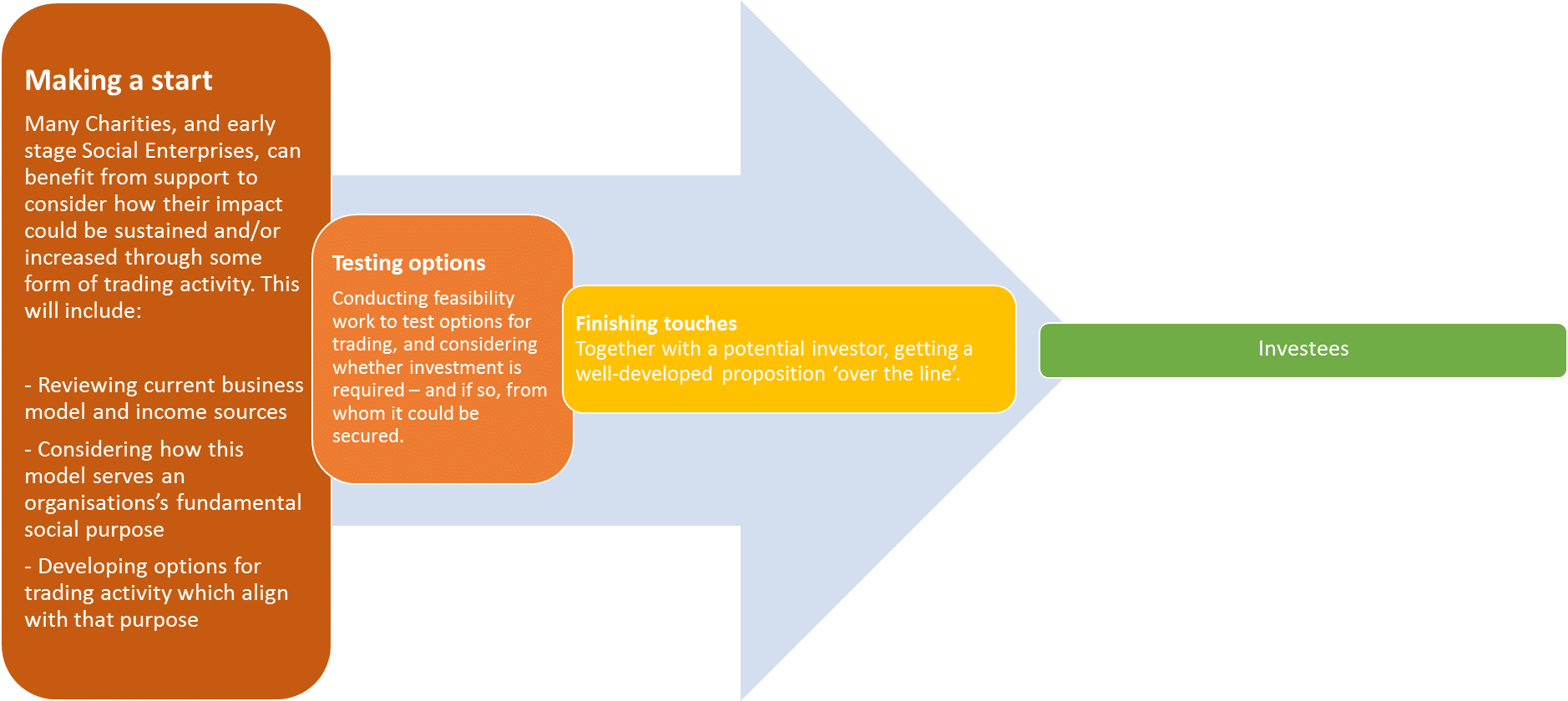

As suggested in the diagram below, there is an important subtlety to bring out in the term investment-readiness: taking on board a message which has been made to us from many people, this process should begin and end with good business planning and an ambition to explore trading activity, out of which may emerge a cogent basis to seek out, get ready for, and take on an investment.

Click image for larger version

This is our mapping out of four broad stages at which organisations may benefit from some form of support. Clearly it is a simplification, and we do not imagine that the process is as neat and linear in practice: it merely provides a structure for us to test and explore over the next couple of months. The overarching question is at which points along a ‘spectrum of readiness’ can we most usefully direct our next set of interventions?

Our Reach Fund is targeted at organisations which are close to the point of investment, but require a small amount of support – finishing touches, in other words. Early evidence is that there is demand for support at this stage, and we are starting to see some Reach Fund grantees going on to take on investment.

Big Potential, meanwhile, has cast its net wider, and has seen many organisations at the ‘testing options’ stage receive support, as well as those making a start. Other programmes such as the ‘Fresh Ideas’ fund have also provided grants for organisations to test out their concept(s) for a trading proposition. As the diagram suggests, the volume of organisations at these initial stages is much higher than the audience targeted by the Reach Fund, so we’re interested to understand how as broad and varied a number can be engaged, in a proportionate way.

Given that the outcome may, in many or most cases, be that they choose not to seek social investment, at least for now, we need to reflect on the balance between building demand over the long term, and meeting needs in the shorter term for those already close to the point of investment. We also want to understand more about what support investees may need after the point of investment: given our ultimate aim is to see organisations become more resilient, our interests must extend beyond the point at which they get ‘over the line’ with an investment.

Across all of these stages, there are the factors of size of investment (are the needs of organisations seeking larger investments different in kind, or simply in scale?), and context (how can the impact of support be increased through a focus on place, ‘joining dots’ and drawing on peer support). Finally, given our interest in impact management, we’re keen to understand how we can build this into our overall approach to investment readiness.

So we have plenty of questions to explore. Between now and the end of June, we’ll be reflecting on our own programme, and seeking your feedback: we’ve put together a google form – as we did in 2015, we’ll collate and share all of the responses. We’ll also be out meeting with as many of you as we’re able, and I’ll be putting out fortnightly posts to update as we go. With good timing, we are also in the process of appointing a learning partner – we received a great set of responses to our call for proposals, and are aiming to announce our chosen partner in the next 3-4 weeks.

If you want to get in touch with us directly at any point, just send us an email: as far as time allows, I would also be pleased to arrange a time to speak on the phone. In whichever format, we’re looking forward to hearing your thoughts…