The endowment working group met again last week to consider how best we invest our £60m endowment from the Cabinet Office.

We began by looking at different portfolio scenarios, generated using our financial model. We considered how the mix of assets would impact both the financial return of the portfolio as well as the financial risk. We also looked at how the grant available for distribution each year would differ depending on how we choose to invest the money.

While financial scenario planning can inform our decision up to a point, we then place an “impact lens” over the mix of assets in each scenario, to determine whether the asset mix being considered is as impactful as possible. In my previous blog, I spoke about Access targeting the “bluest” portfolio – in other words, one where the financial assets chosen also achieve the greatest social impact, as defined by Access’s goals and mission.

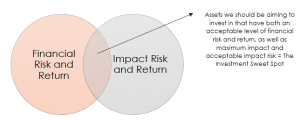

We found it helpful to think of the interaction between Financial Risk and Return and Impact Risk and Return in terms of the diagram below:

click image to view larger version

Ultimately we are trying to determine an asset mix within our portfolio that ensures we have cash available when we need it, an acceptable level of risk (both financial and impact) resulting in the desired social and financial returns. We have called this “The Investment Sweet Spot!”

We have started to look at the types of investments that are already available in what we believe to be the Sweet Spot. Broadly speaking, these assets might include cash deposits in ethical banks, bonds with social impact, sustainable equity funds or private equity social impact funds. The actual asset allocation mix is still something we’re working on, which will then inform the investments we choose. It does feel like we are getting closer though!

We are meeting again in 3 weeks’ time and I look forward to sharing the next part of conversation with you soon.