Scheme will target smaller charities and social enterprises based in deprived areas.

Access – The Foundation for Social Investment is set to receive £20m from dormant assets to extend its support for charities and social enterprises in England, it was announced today. The £20m from dormant assets will enable finance to flow to charities and social enterprises looking to grow or diversify their business models, particularly those unlikely to have taken on social investment before such as smaller organisations or those based in deprived areas. The finance offered will principally be in the form of small flexible unsecured loans to organisations seeking to use the funds to create more social impact.

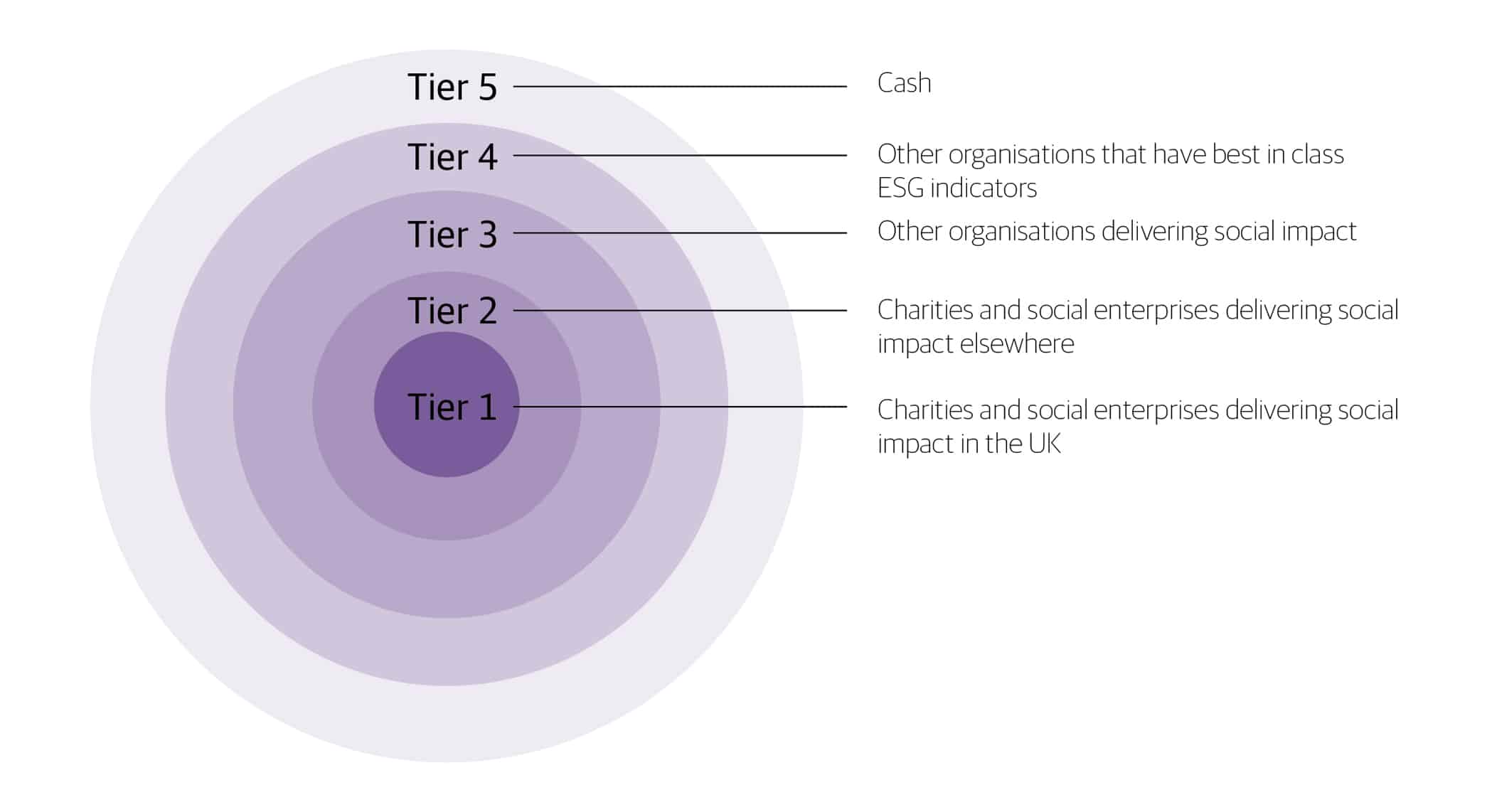

Access will make the £20m available to social investment providers as grants for them to match with finance raised from other investors, allowing them to offer the type of finance that smaller charities and social enterprises need – typically smaller pots of money to organisations without an established history of taking on finance.

This new programme will significantly increase the availability of finance to charities and social enterprises and help to improve the lives of people and communities. It will build on the Growth Fund, a £50m partnership which uses a combination of grant funding, made possible thanks to National Lottery players, and loan finance from Big Society Capital and other co-investors, to address specific gaps in the social investment market. The programme, delivered by Access through a range of social investors, has transformed the social investment market over the last six years and is due to make its final investments in 2022.

The Growth Fund significantly increased the supply of smaller scale unsecured loans and targeted funds to those areas most in need – with half of Growth Fund invested in the most deprived 30% of neighbourhoods. Over 600 investments have been made by the 14 social investors, with an average investment size of £67k. This is much closer to the clear pattern of demand from the sector for smaller amounts of finance than the wider social investment market (an SEUK survey found that social enterprises were asking for a median amount of 50k). Overall, the latest data available suggests that the programme contributed around a fifth of the loans made by social investors over the last few years.

Seb Elsworth, chief executive of Access – the Foundation for Social Investment said:

“Communities need the support that charities and social enterprises can provide, creating vital jobs and addressing entrenched social problems. But too often, they can struggle to get the finance they need to innovate or grow. The additional £20 million from dormant assets will help us and our partners to deliver the small-scale loans that most charities and social enterprises need and further target investment into places and communities that have been previously overlooked.

“To date, the Growth Fund has supported charities and social enterprises in some of our most deprived communities, four times that of the wider social investment market, by combining grants with loans in a blended finance package. Drawing on what we have learnt to date, we will target this additional investment in the best way possible, increasing the availability of smaller scale unsecured loans for charities and social enterprises.

“Because of its reach into communities, blended finance is now an essential part of the social investment market. This builds on the work we and others have done to date and the sustained commitment of early pioneers such as the National Lottery Community Fund, the largest funder of community activity in the UK, who should be applauded for supporting the development of an investment eco-system that works for all charities and social enterprises, particularly smaller organisations or those working in deprived areas.”