Access – The Foundation for Social Investment has opened an expression of interest (EOI) process for organisations who make social investments into charities and social enterprises in England to apply for grant to blend into programmes offering emergency lending to the sector.

In May 2020 it was announced that Access – The Foundation for Social Investment will receive £30m of new funds from dormant accounts to support the development of new blended finance models for social investment providers to make available to charities and social enterprises impacted by the COVID-19 crisis.

The funds will be made available in two distinct phases, and this EOI process is for the first of these.

- To support social investors who are offering emergency loans to charities and social enterprises to help those organisations who need to access finance quickly to help them cope with the challenges which have arisen from the COVID-19 crisis.

- To support social investors in developing, designing and delivering new financial products to support charities and social enterprises in the recovery to rebuild their businesses and the impact they deliver in communities around the country.

Access expects to commit up to £10m for this first phase.

Access will open an EOI process for the second phase on recovery finance later in the summer.

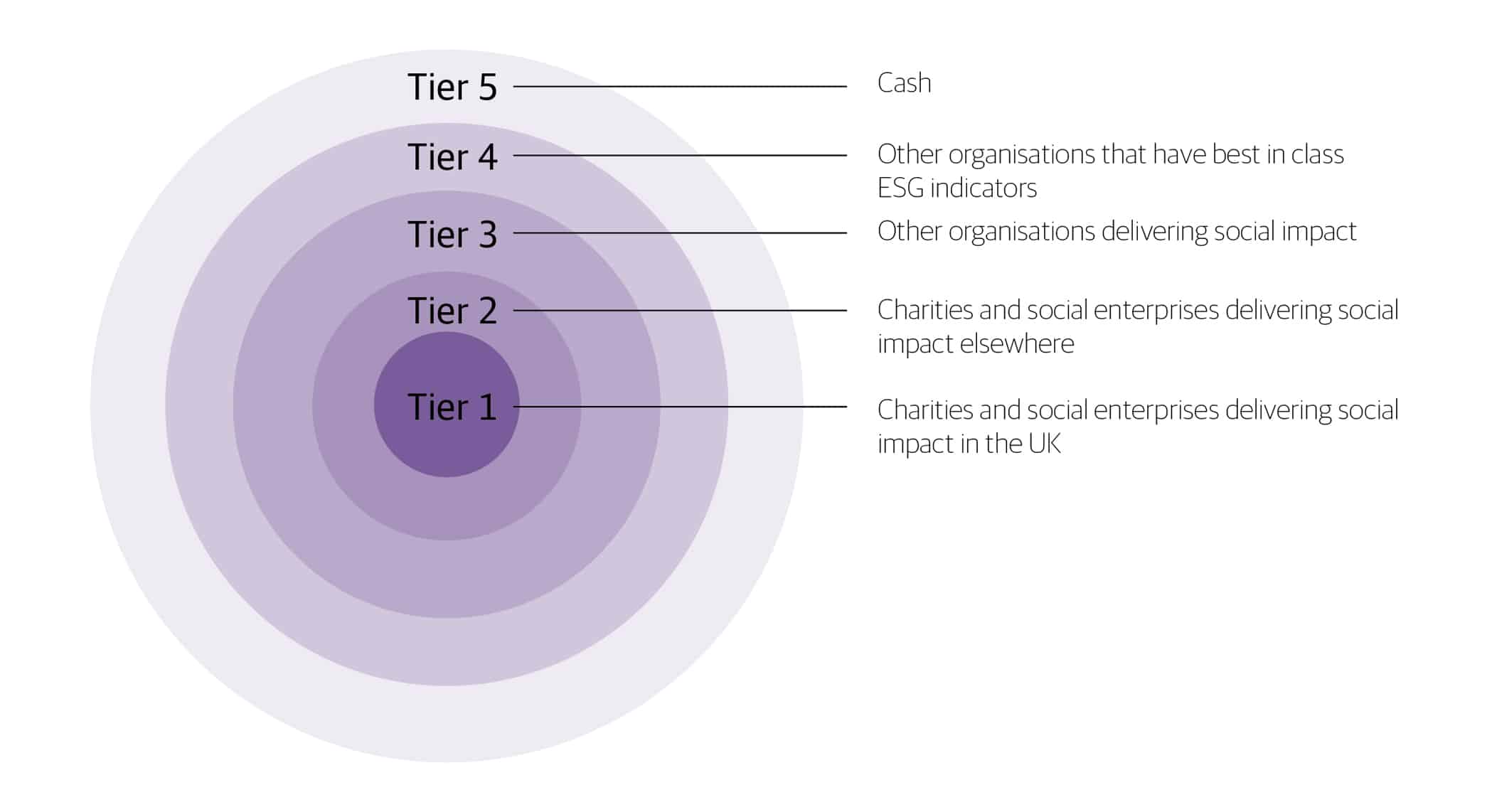

The grant which will be made available to social investment providers is intended to increase the number of charities and social enterprises who can benefit from taking on repayable finance as part of managing the short term impact of the COVID-19 crisis on their finances, and thereby helping more organisations to survive and to continue to deliver impact for their communities in the future.

Creating a blended offer, for example so that social investment providers can provide loan and grant together rather than just pure loan, should mean that those social investment providers have products which are more suitable to the needs of a greater number of charities and social enterprises.

This may be because the crisis has resulted in both a need for working capital and/or capital investment alongside some grant to help address the interruption in their revenue. Or because their need for capital now is greater than their likely ability to repay over time.

Social investment providers looking to apply for grant to augment their offer need to be able to move quickly. Access expects these funds to be committed by the end of the year. Therefore social investment providers need to have the necessary systems and processes already in place as well as the repayable capital which will be blended with the grant.